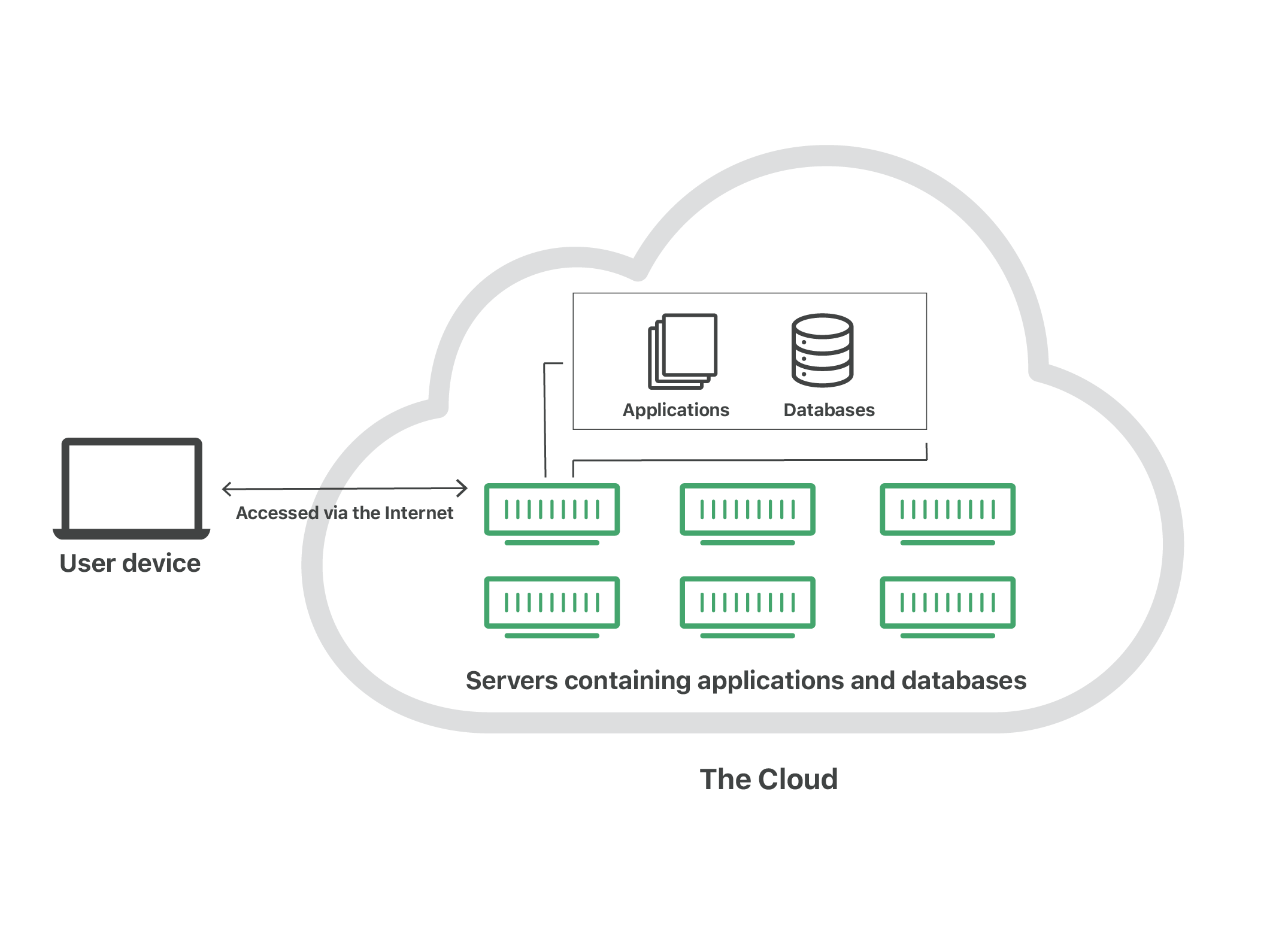

“The cloud” refers to servers that are accessed over the Internet, and the software and databases that run on those servers. Cloud servers are located in data centers all over the world. By using cloud computing, users and companies do not have to manage physical servers themselves or run software applications on their own machines.

The cloud enables users to access the same files and applications from almost any device, because the computing and storage takes place on servers in a data center, instead of locally on the user device. This is why a user can log in to their Instagram account on a new phone after their old phone breaks and still find their old account in place, with all their photos, videos, and conversation history. It works the same way with cloud email providers like Gmail or Microsoft Office 365, and with cloud storage providers like Dropbox or Google Drive.

For businesses, switching to cloud computing removes some IT costs and overhead: for instance, they no longer need to update and maintain their own servers, as the cloud vendor they are using will do that. This especially makes an impact for small businesses that may not have been able to afford their own internal infrastructure but can outsource their infrastructure needs affordably via the cloud. The cloud can also make it easier for companies to operate internationally, because employees and customers can access the same files and applications from any location.

Is it worth paying for cloud storage, or could you get away with a free service?

Moving your files, photos and documents online to the cloud is one of the smartest computing decisions you can make. With your most important files stored safely online, you don’t need to panic about your laptop seizing up or your external hard drive breaking down. Even if your computer is lost or stolen, you’ll still be able to access your documents or photo collection online through the cloud. But, with all the cloud storage options out there, how do you pick which one to use? Some make transferring files a seamless task, whereas others are more trying. Follow our advice to free up more of your precious time. Below, we cover some key things to think about when choosing your cloud storage service, such as whether you should pay for it and features to look out

That depends on how much storage space you need. Many of the big-name services offer between 2GB and 5GB for free, which isn’t much. But some offer more, including Google Drive, which gives you 15GB free of charge. If you want more space, you’ll need to pay an annual or monthly fee. Of course, there’s nothing stopping you from setting up multiple free accounts and enjoying a sizeable combined amount of storage. But this could become confusing and annoying – and you probably don’t want to spend too much time going through all your accounts to find one specific document.

Which cloud storage service features should I look out for?

Not all cloud storage services offer the same functionality, so make sure you pick one with all the features you want. Here’s a list of some key ones to think about:

- Multi-device access You can use most cloud storage services on your smartphone or tablet, as well as on your laptop or desktop. But check that a service has dedicated apps for your brand of tablet or smartphone.

- Editing Surprisingly, some services don’t let you edit documents within cloud storage itself – instead, you open the file outside of the storage service, then it syncs automatically. Many give you the option of both, though, giving you a little more flexibility. Some cloud storage services let you edit pictures, too.

- File sharing Most services let you share your files with other people – for instance, you might like to share some holiday snaps with your family. Some don’t, though, so consider whether it’s something you’d like to do

- Security it’s imperative that the brands behind those services protect all the data they hold to withstand breaches from even the most devious attackers, so the best cloud storage services won’t accept weak passwords. It’s also good if two-factor authentication is available. This form of security requires you to enter your password, but then an extra code is sent to one of your personal devices (usually a phone), which you’ll then need to enter to log in.

Comparison of the Best Free Online Cloud Storage

| Cloud Storage Providers | Best For | Storage space plans |

|---|---|---|

| iCloud | Apple Users (ipad, iphone) | 5GB, 50GB, 200GB & Unlimited |

| Dropbox | Light data users. | 2GB, 1TB, 2TB, 3TB, Till Unlimited. |

| Google Drive | Teams & Collaboration | 15GB, 100GB, 200GB.. Till Unlimited. |

| OneDrive | Windows users | 5GB, 50GB, 1TB, 6TB, & Unlimited. |

Recent Comments